There wasn’t a better time for the new investors to invest in the stock market. Development in algorithmic trading and technology over the last few years has enabled new investment brokerages and apps to emerge. Most of the brokerages and applications are free for U.S. users. In this guide, we have outlined the top 5 free investment apps and platforms.

Let’s begin with free stuff. What sort of promotions do the brokerages provide? All of these applications have different uses. For instance, M1 has dividend investing, whereas Webull has active traders.

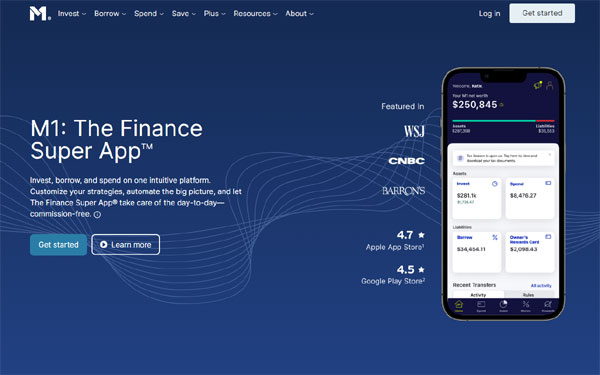

M1 Finance App

M1 Finance is a new investing application enabling users to automate their investing 100 percent for free. They are a hybrid between a brokerage and a robo-advisor.

Investors can invest in lots of stocks and ETFs with the M1 platform. After building a portfolio and adding funds, users can sit back and automatically permit their portfolio to be rebalanced by the M1 Finance app. You should continue the contributions. M1 will put your stock market portfolio on autopilot.

M1 Finance platform functions when users generate a portfolio known as a pie. Users select the particular ETFs and stocks that make up the pie in each pic. For instance, users can have a pie of 50 percent Netflix and 50 percent Facebook stock.

Users can have infinite pies on the M1 Finance app and the option to place hundreds of holdings in one pie. For instance, users can have an income and growth pie on M1 Finance.

M1 Finance also provides expert pie generated by safety professionals on the platform. M1 is a platform that provides this service on an entirely free investing application. These pre-built pies serve specific investment goals. Investors can invest for their retirement, follow particular sectors and industries, and follow the desired hedge fund managers.

Investment Pies

Pie investment via M1 Finance enables users to manage a diversified portfolio even with a small investment account.

One of the issues users have encountered for years is having a diversified portfolio without having thousands of dollars to invest. M1 Finance has made a solution by enabling users to invest with fractional shares.

By buying as small as 1/10,000th of the share, M1 Finance enables users to remain completely invested.

Dynamic Rebalancing

This is the most useful feature of M1, allowing users to ease their investments. When users add funds, the M1 Finance platform will purchase whatever they are underweight. When users take out funds, M1 Finance sets off whatever they are overweight in.

So, M1 purchases low and sell high on the users’ behalf. Dynamic rebalancing permits users to add and move funds knowing that users won’t have to purchase or sell positions themself actively.

In-build Tax Efficiency

M1 Finance enables users to lower their tax liability by utilizing tax-efficient plans when selling investments. M1 Finance is a free investing platform that provides a tax-efficient selling plan.

Webull App

Webull is a renowned commission-free option, stock, and ETF trading application that is a more vigorous version of Robinhood. Well is a great option for those seeking a research-oriented, dynamic interface. Its features benefit users, like research agency ratings, technical indicators, free margin trading, financial calendars, and short selling.

With quick access to research tools, live data, and margin, Webull has created the best platform for active users.

Webull app is ideal for intermediate users who have experience with the stock market. Beginners may find the information overload. If you have some experience, Webull provides you with all the important data you will require.

Technical Indicators

Webull has plenty of technical indicators accessible on the platform. Users can select from technical indicators like relative strength, moving averages, etc.

Another important function is candlestick charts. Users can switch between general candlestick charts and line charts in the app.

Digital Trading Simulator

Webull has a helpful feature known as a virtual trading simulator. This feature allows users to build a digital portfolio with fake currency to test the strategies before risking traditional currency.

This is the best feature for beginners, who may require to gain investing knowledge and learn how before investing traditional currency.

Smart Alerts

Webull allows users to set alerts for multiple holdings. The platform sends users alerts when a cost level hits or the rate of changes has hit the defined level. Also, alerts for changes or volume levels can help users put stock in the short term.

Margin Trading

Webull enables margin trading on the platform for particular users. Users should have the lowest account balance of 2,000 dollars for margin trading approval.

Robinhood App

Robinhood app is user-friendly and aims at beginners seeking to save funds by avoiding commission fees.

Robinhood enables users to trade ETFs, options, digital currencies, and stocks commission free. Robinhood has a simple user interface and offers a better user experience for beginners.

After using Robinhood, you will find that this platform has become very restricting. It is simple for beginners; they will likely outgrow it in a couple of months. The absence of fundamental/technical metrics and charting is a general complaint among users. Robinhood is an easy-to-use platform.

Commission Free

Robinhood enables users to trade options, virtual currencies, socks, and ETFs for free. Investors can save funds on fees. This is particularly helpful for active users who make frequent trades.

Easy-to-Use Interface

Robinhood is user-friendly and not overwhelming like others. This benefits users who have just begun and need a secure and simple-to-use platform.

For users seeking to conduct research and make trading strategies, Robinhood is worth considering.

Moomoo App

Moomoo is a secure and advanced trading application that customs shorter-term users. The app offers a notable amount of information and research that users will find useful. The new traders might find this app intimidating. The user interface is more complex than user-friendly apps such as Public and Robinhood, but professional users may find it what they seek.

Users can buy ETFs, options, and stock contracts in the app. Also, the users can execute short sales and initiate purchases on margin which is beneficial according to your trading strategies.

Moomoo also provides paper trading for beginners or those who wish to get a feel of the platform before putting their funds on the line. With paper trading, you will get 1,000,000 dollars in fake currency to practice trading strategies.

Improved Features for Users

As a trading platform, Moomoo provides advanced features in which traders will find notable value. On the platform, you can access increased-hours trading. This will enhance the trading window. Remember, the markets are ideally more volatile outside of normal hours.

Also, the users can benefit from Level 2 market information without additional cost. This gives users more data on the purchasing and selling activity of a specific stock and is helpful for users seeking to take benefit from short-term cost movements.

Public App

A public app is a social investing application that makes it easy to own the companies users believe in with the desired amount of funds. It aims to make investing educational, inclusive, and fun.

Professionals developed the Public app to allow members to purchase slices of ETFs and stocks, learn from the transparent community of financial professionals, and follow interest-based themes.

Users can invest in funds and stocks commission free. It is distinctive that users can follow other inverters, exchange ideas with investors, and check their portfolios.

Presently, the app doesn’t have premium features that have a fee, but as they introduced products to the platform, they can take a particular subscription charge. Public importantly converts the stock market into a social endeavor, enabling users to become part of a community to share wisdom.

Users can begin by purchasing desired stock with zero minimum required. One can buy micro amounts of stock for 5 dollars.

Free Stock Slice

The Public app gives users a free 10-dollar stock slice during sign-up. There is no lowest amount to receive this stock. Also, you can select the stock you wish to obtain from a collection of leading companies such as Amazon.

Also, users can gift stocks to their friends for free. You can choose the desired stock, send it through email or tweet, and your friend will get about 50 dollars of free stock. To redeem stock gifts, your friend should sign up for Public.com. Public designed stock gifts to motivate new users to begin investing, so the existing Public users aren’t eligible to obtain gifts. Users can transfer stock gifts to a U.S. citizen above 18. You can gift as many as you want; the only restriction is one gift obtained per person.

Another advantage for users: Publick features a watchlist so investors can monitor companies that interest them and check the news stories about them.

Also Read: 13 Best Solana Wallets of 2023

Conclusion

If you are new to the investing world, the foremost decision you must make is what investing app or platform to begin investing with. There are many brokerage platforms to pick from, each providing different services. However, the deciding factors depend on your preferences and priorities. The above guide can help you to understand the top 5 investing apps in detail and make your decision easy.